AI Agents for Digital Finance

Deploying secure AI for digital finance

Help customers with AI workflows and multilingual support on channels like WhatsApp, Viber, and LINE.

Book demo

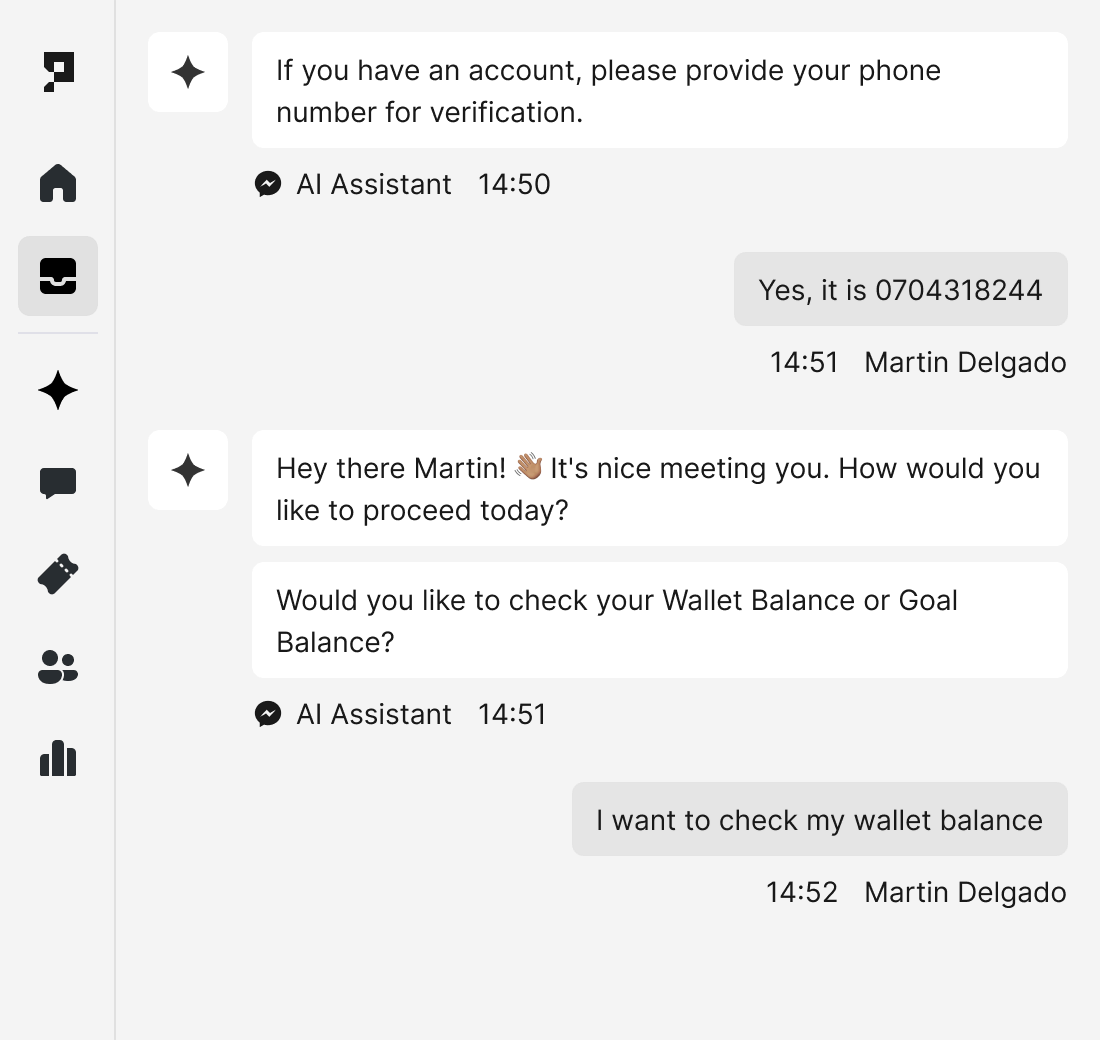

What's my wallet balance?

Identify customer

Start verification

A verification code has been sent to your mobile. Please enter it to proceed.

814589

Retrieve balance

Thank you, Martin.

Your balance is $156.94.

Deliver financial service at speed

Analytics

Understand customer behaviour

Get a direct view into financial product efficacy with conversational surveys and customer feedback.

Engaged customers

4590

23%

Average rating

4.8

38%

Inbox

Maximise your live agent team

Optimise customer support with time-saving AI tools and workflows for live agents.

Tickets

Auto-populate financial customer tickets

Automatically fill ticket tags, custom fields, and customer profiles from chat data.

Channels

Provide accessible customer support

Deploy AI customer support directly into messaging apps like WhatsApp and LINE for global coverage.

Integrations

Conversational payment options

Offer payment processing and troubleshooting directly in the messaging interface to reduce support tickets.

tgl

Tagalog

ceb

Cebuano

rw

Kinyarwanda

kj

Oshiwambo

Speak in 100+ languages

Local Languages

Engage everyone in their native language

Proto's local language models extend beyond the reach of generative AI.

Integrations

Connect to CRMs and payment apps

Proto integrates with your business infrastructure.

Secure webhook with data encryption

Proto does the heavy lifting so you can focus on implementation.

Bulk import and export for customer data

Minimize effort when migrating big data between systems.

APIs for tickets, livechats, customers and analytics

Connect Proto content into your software stack.

iFrame for payments inside customer chat

Embed checkouts directly in chat to maximize conversion.

Progress for your organisation

Proto is the AI localisation and security partner for emerging industry leaders.

ISO 27001

SOC 2 Type II

HIPAA

GDPR

Dedicated LLM

AI Assistant switching

CRM and IVR integrations

On-premise hosting

Custom SSO configuration

Roadmap prioritisation

Surveillance metrics

Unlimited support

ISO 27001

SOC 2 Type II

HIPAA

Dedicated LLM

GDPR

AI Assistant switching

CRM and IVR integrations

On-premise hosting

Custom SSO configuration

Roadmap prioritization

Surveillance metrics

Unlimited support

Built-in data privacy and security

Proto's platform architecture is adaptable to data privacy with on-premise hosting and proprietary AI when large language models are restricted.

Protection standards

Trust in audited standards

SOC 2 Type II

HIPAA

ISO 27001

Data residency

Host onsite or hybrid

Deploy with local hosting solutions that are setup within two weeks.

Data access

Enforce IP access

Limit Proto platform access to offices and remote workers with authorized IP addresses.

Data privacy

Encrypt messaging

All messaging is SHA-256 encrypted at rest and in transit.

Hello Sam!

In accordance with new regulation, we require your government issued ID for international banking.

Learn more

Upload passport

Upload driver's license

Process every interaction

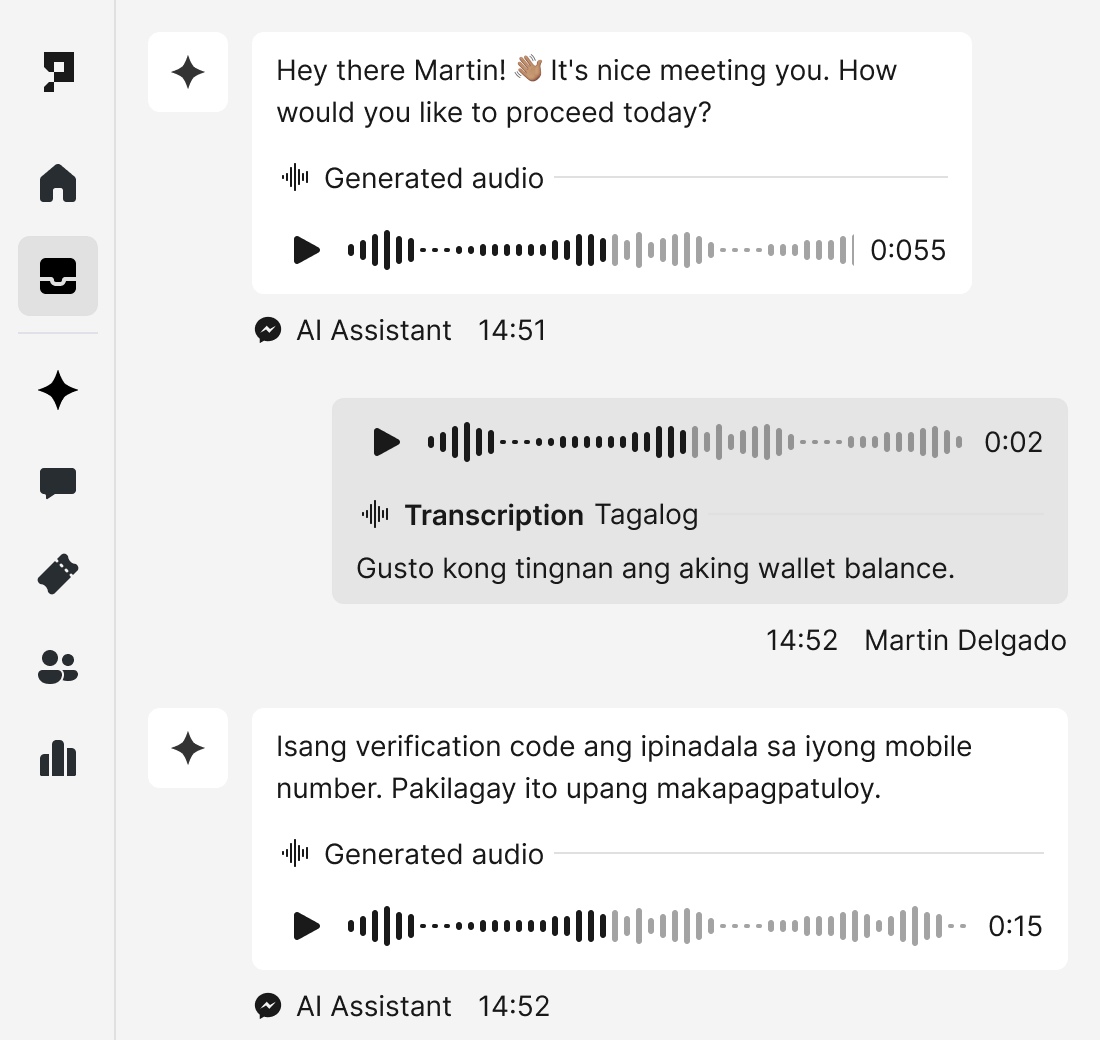

Messages

Send and receive text messages.

Voice

Send and receive voice messages.

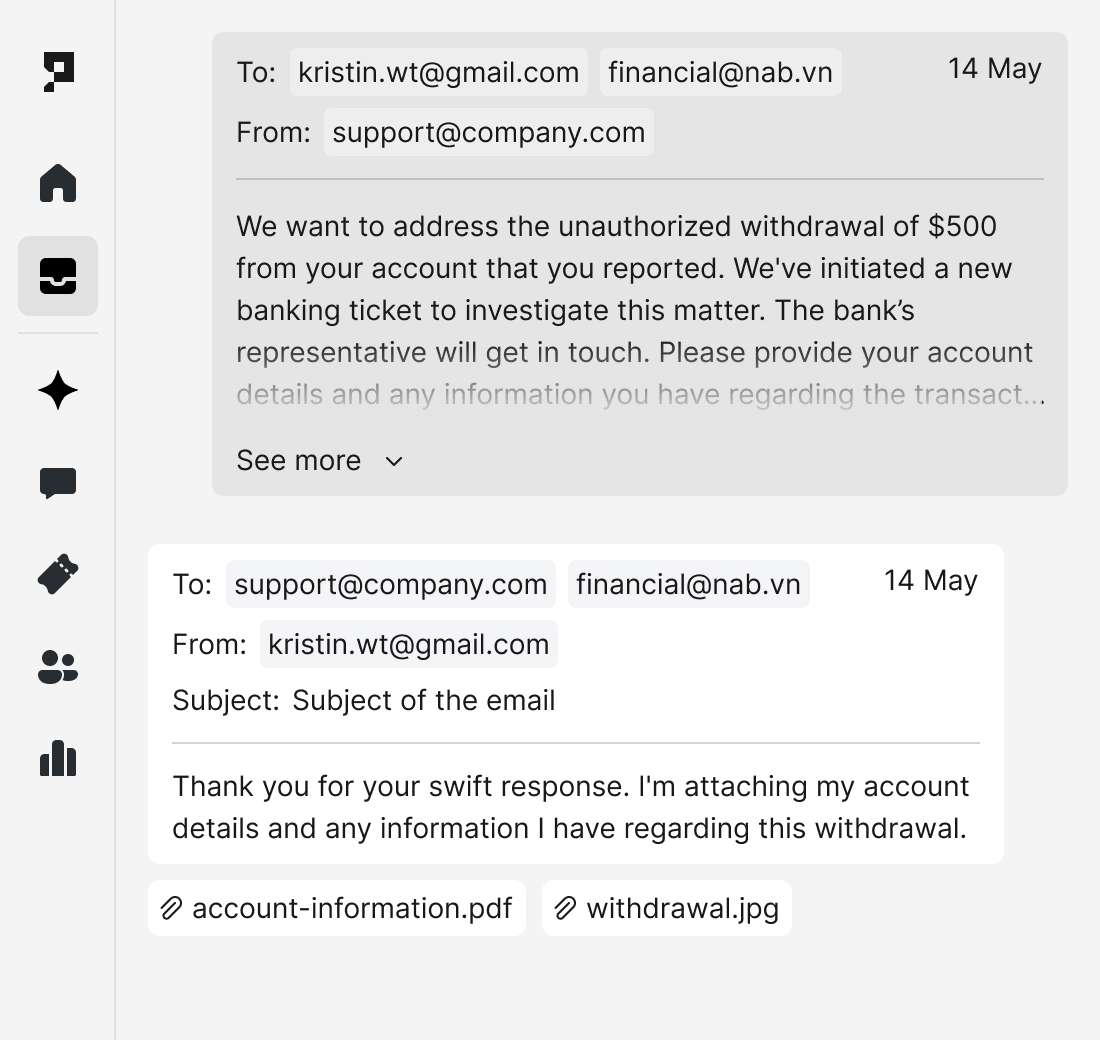

Emails

Send and receive ticketing emails.

Translations

Help live agents serve 100+ languages.

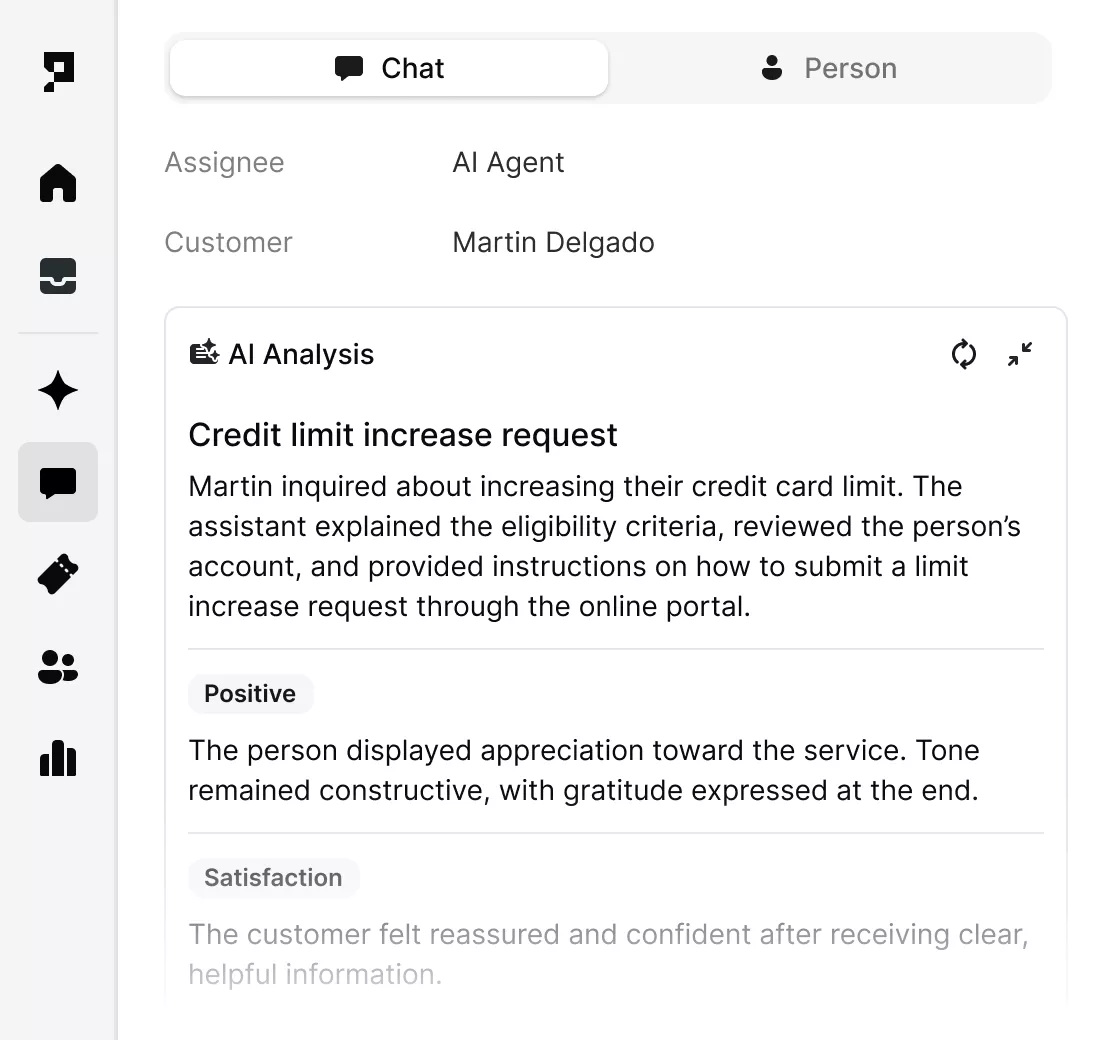

Auto-tags

Automate tag selection across chats.

Auto-fields

Automate custom fields assignment.

Summaries

Review chat and ticket summaries.

Scrapes

Analyse posts and comments across social media.

Insights

Generate text and graphical analysis.