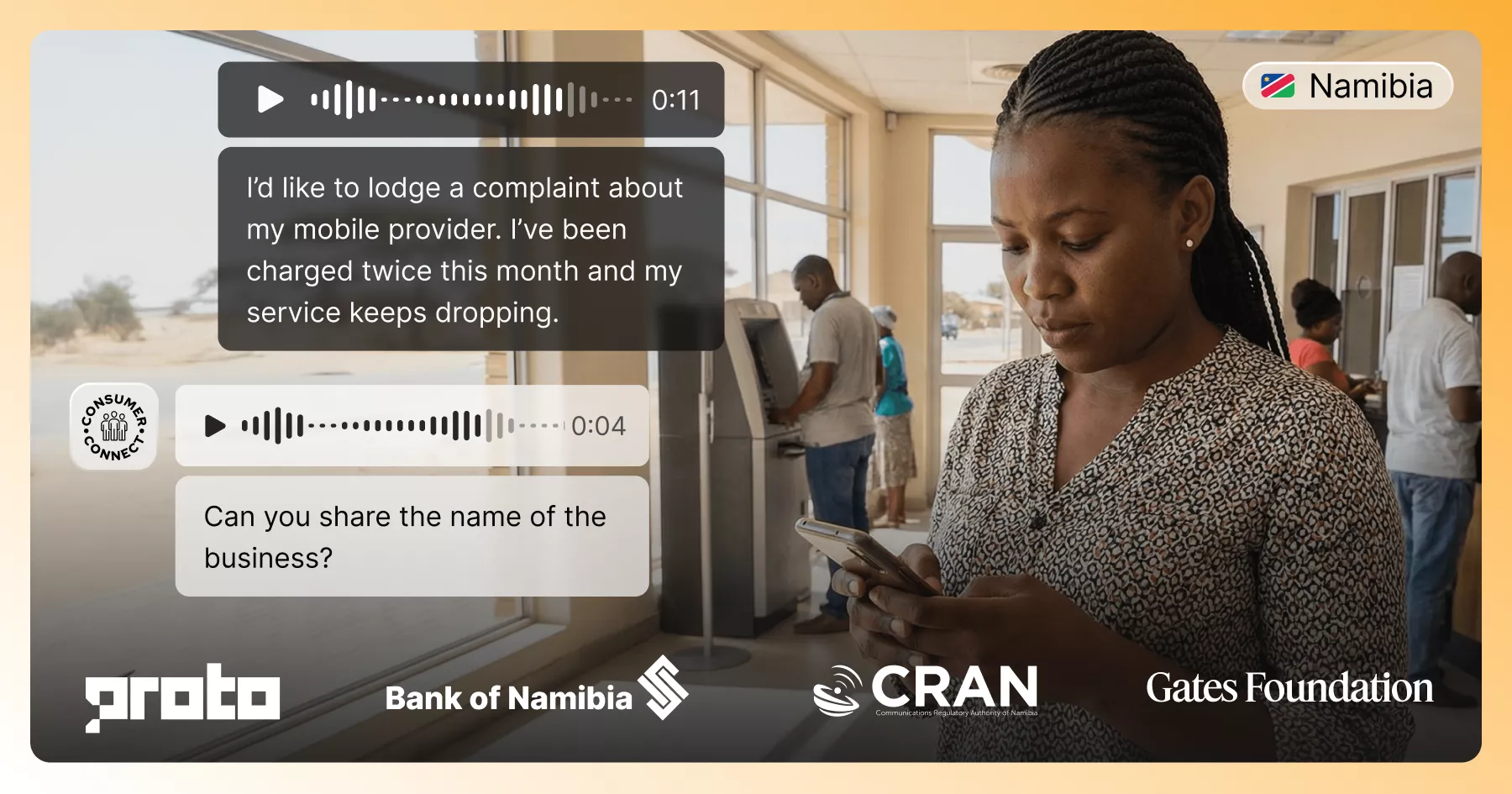

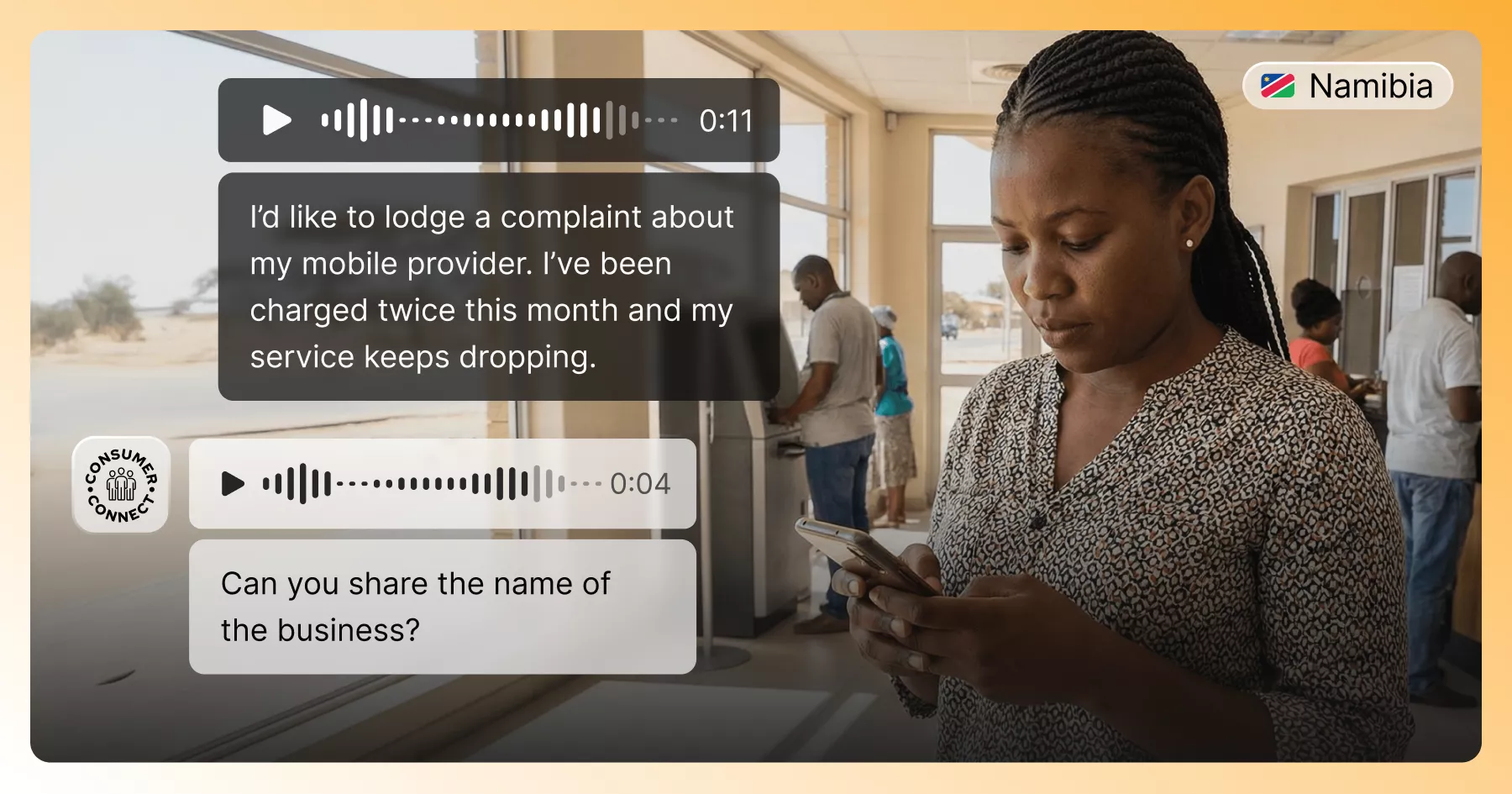

The Bank of Namibia and Communications Regulatory Authority of Namibia have launched the ConsumerConnect pilot for citizen support and complaint resolution. This integrated AI agent network is designed to bring together over 2,000 banking, insurance, non-banking, and telecommunications businesses to streamline and guarantee an inclusive standard for consumer recourse – at a time when Namibia faces unprecedented levels of financial scams and market risks.

The integrated AI solution now connects regulators into a unified citizen support platform that speaks Afrikaans, English, German, and Oshiwambo – starting with the most-spoken Kwanyama dialect. This deployment marks the culmination of a comprehensive design and development project funded by the Gates Foundation that began earlier this year with the Bank of Namibia (BON), the Namibia Financial Institutions Supervisory Authority (NAMFISA), and the Communications Regulatory Authority of Namibia (CRAN) participating directly in the design phase.

Gates Foundation Senior Program Officer Jeremiah Grossman said: "The foundation is investing in consumer protection AI tools to build trust in digital services for the lowest-income communities. Through these projects, we aim to demonstrate the value of automated grievance redress for citizens, regulators, and governments – and spark wider adoption across emerging markets."

A collaborative approach to consumer protection

The ConsumerConnect system is built on Proto’s AI agent and case management platform, already deployed by governments such as Rwanda and the Philippines. The system enables Namibian citizens to submit complaints to any of the participating regulators through webchat or WhatsApp – without needing to know the regulatory mandates. For example, if a consumer thinks a microloan issue can be resolved by the Bank of Namibia, they are welcome to start the complaint in BON’s WhatsApp channel

Bank of Namibia Technical Advisor to the Governor Romeo Nel said: “This initiative marks a key milestone for us as regulators to adopt a more inclusive approach to handling complaints. As we all know, complaints come as matters of urgency. With advancements in AI, we now have the opportunity to automate this process and shift from a reactive to proactive approach that serves our people, strengthens accountability, and renews public trust. We are confident that this innovation will serve the people we represent."

These complaints are received and referred to the correct regulator all within a single, simplified chat session. Citizens then have have their complaints routed to regulated business for monitored resolution, and if necessary, investigation.

Importantly, the ConsumerConnect trial in October received the compliance of 288 regulated entities, with 27 of the larger enterprises opting for direct integration or use of the ConsumerConnect platform for their replies to citizens. Testing feedback from the private sector was 92% positive, with enhancement requests incorporated into the complaint dialogue.

To ensure the long-term sustainability of this public utility, the Foundation’s implementation funding through Proto was delivered with a novel shared service model. After sponsorship, a single license for the software and data hosting can be split by the regulators and future government agencies to operate ConsumerConnect at a decreased unit cost – while maintaining data sovereignty with on-premise hosting.

During the implementation of ConsumerConnect, the Proto platform was adapted to include:

- Voice & text AI tailored to Namibian languages, starting with Oshiwambo, built on ProtoAI and fine-tuned beyond generic large language model capabilities.

- Data protection measures such as on-premise hosting and enterprise-grade security standards.

- Multi-channel access via WhatsApp, web, and voice – ensuring inclusivity regardless of tech literacy or device.

- Supervisory analytics with social media scraping to help regulators spot trends and correlate risks with bona fide complaints.

Why financial inclusion depends on AI-powered consumer protection

Across Africa, digital financial services like mobile money are improving consumer access – but they are also introducing new risks such as scams, mis-selling, and data misuse that disproportionately impacts low-income users.

The latest 2025 data from the Global Findex show that 22% of unbanked individuals in low- and middle-income countries (LMICs) cite a lack of trust in financial institutions as a reason for remaining unbanked. In Namibia, a TransUnion study from December 2024 found that 63% of adults – including those recently banked – reported being subject to a financial scam. Of that group, 11% were comfortable to share that they had indeed become victims and lost money.

Globally, the industrialised scam industry is surging, surpasses $1 trillion in scammed funds last year according to the Global Anti-Scam Alliance. This equates to anywhere between 1-3% of global GDP. These scams weaponise AI tools and disproportionately affect new and vulnerable financial consumers, especially senior citizens. Unfortunately, in low-and-middle income countries, fraudulent fund recovery languishes at less than 1%. The scale of this problem threatens to erode the past decade’s gains in financial inclusion, in particular the trust we place in digital and instant payment systems.

The common human and technical factors exploited by scammers include delays in victim reporting, often due to embarrassment or a lack of awareness of recourse options, as well unclear processes between law enforcement, regulators, and financial institutions. Typically, there is a 24 hour window to trace, freeze, and confiscate scammed funds – after this, the money has been transited through too many mule accounts and across borders so as to become untraceable.

ConsumerConnect directly addresses this prescient threat to financial inclusion through its 24/7 multilingual AI interface that makes it simple for victims to report fraud immediately – even in moments of panic or embarrassment. By reducing barriers to reporting and enabling instant routing to the appropriate regulator or financial institution, the system maximizes the critical window for fund recovery before scammed money becomes untraceable.

Proto CEO Curtis Matlock said: "Namibia's network of AI agents will be on the frontline of triaging citizen complaints and scam reports. With the strong public-private cooperation demonstrated during the Gates Foundation’s funding period, Proto stands ready to evolve the system – ensuring the trust of Namibians in their financial system."

About BON

The Bank of Namibia is the central bank of Namibia, responsible for promoting monetary stability and a sound financial system. It regulates banking institutions and serves as the government's banker, financial advisor, and fiscal agent.

About NAMFISA

The Namibia Financial Institutions Supervisory Authority regulates and supervises financial institutions and financial services in Namibia. It works to foster a stable and fair non-banking financial sector and to protect consumers of financial services.

About CRAN

The Communications Regulatory Authority of Namibia regulates telecommunications services, broadcasting, postal services, and the use of the radio spectrum. It aims to promote competition, protect consumers, and ensure accessible, quality services.